fresh start initiative expires

As seen in the news. The IRS Fresh Start Program.

Here S What It Looks Like When A 112 000 Irs Balance Expires Landmark Tax Group

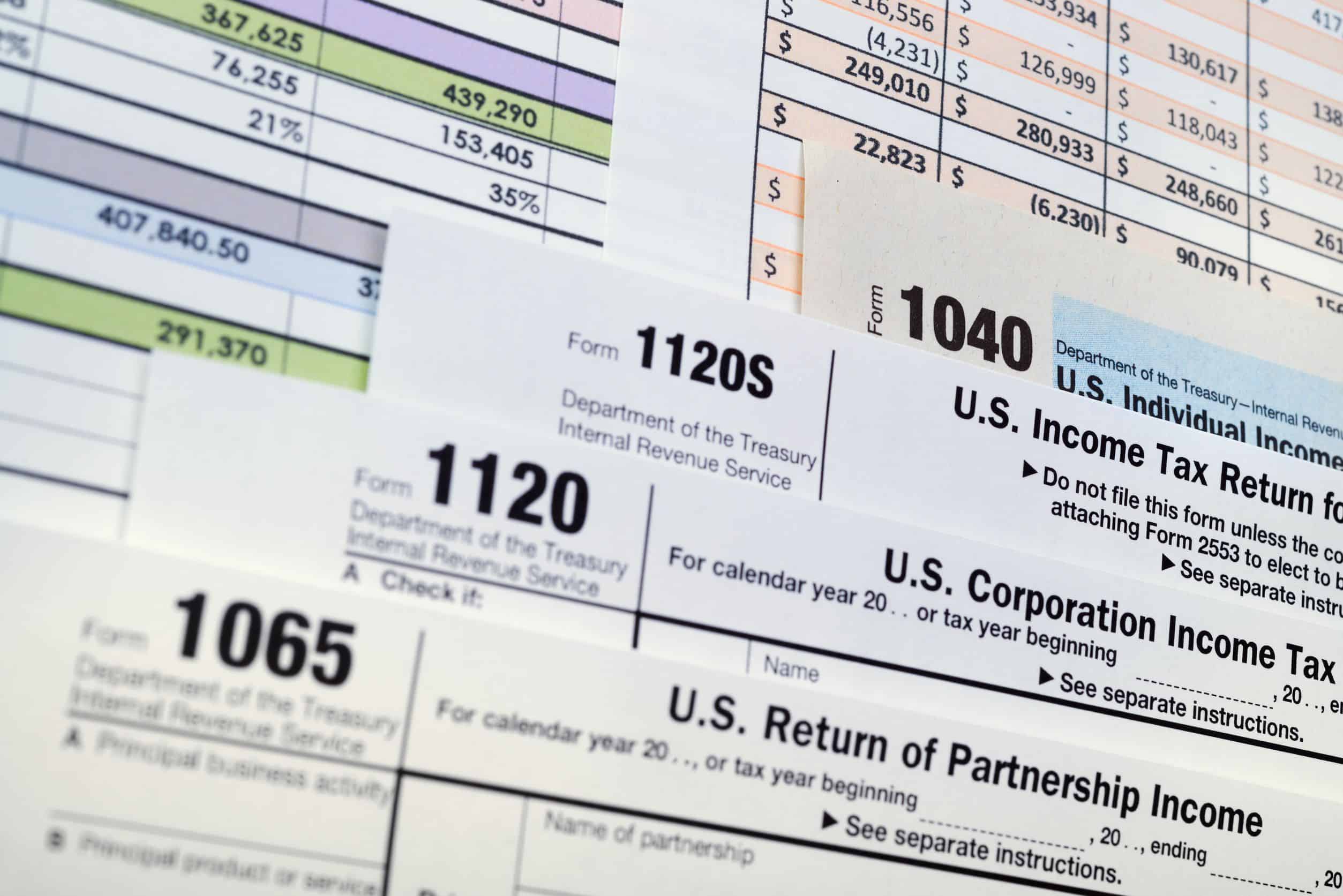

The IRS established Fresh Start Initiative to help people with tax debt under 50K.

. FREE CONSULTATION NO OBLIGATION. In-business trust fund installment agreements are for debts of no more than 25000. The primary objective of the FSI was to give taxpayers who owed substantial back taxes the.

Not available in all states. GET A FREE TAX QUOTE. It offers varying levels of relief and repayment options based on the specific financial situation of each applicant.

With the New IRS Fresh Start Initiative its possible to have your IRS debt reduced by as much as 100 - this survey qualifies Americans in under 2 minutes. We Are Here to Help. Let us give you a helping hand today.

Check If You Qualify For Free. Program does not assume any debts nor provide legal or tax advice. In-Business Trust Fund installment agreements.

The Fresh Start Program is a collection of changes to the tax code. The IRS Fresh Start Program isnt just for your benefit. Yes taxpayers benefit from being able to pay off tax debts while avoiding liens levies wage garnishments and jail time.

Generally payments are made until the IRS statute of limitations on collections expires. Unpaid taxes can cripple even the strongest. However the future is.

Now with the Fresh Start program taxpayers can pay off their tax debts through the different IRS-approved installment plans. It is for the IRS. The IRS began Fresh Start in 2011 to help struggling taxpayers.

Everyone is hoping for the pandemic to end by next year. Learn more about the IRS Fresh Start Program here. Program does not assume any debts nor provide legal or tax advice.

So in short the Fresh Start Initiative is still in place in 2019. This was in response to the critics law makers and the fact that people were still being impacted by the recession. Fresh Start offers you a chance to avoid the IRS Failure to File penalty placed on unpaid tax balances with accumulated interest.

The IRS began the Fresh Start program in 2011 to assist more taxpayers regain good status. Before Fresh Start Initiative Expires. Check If You Qualify For Free.

Theres a relief program that consolidates many major relief programs into a one-size-fits-all assistance program. Before Fresh Start Initiative Expires. Read and understand all terms prior to enrollment.

IRS Installment Agreements. The coronavirus has impacted many individuals and businesses. Propose to pay off your tax debt within the Collection Statute Expiration Date which basically means you will pay it off before the tax debt expires and the IRS will accept the payment plan.

Founder Derrick Kiser created evidence based solution-focused prevention and intervention programs that addresses critical issues that has a negative impact in individual life. Our clients are referred to our Fresh Start Program in order to avoid bankruptcy acquire debt relief and settle their debts in a quick manner. Individual taxpayers and small businesses are most likely to benefit from Fresh Start.

You are eligible for an OIC if you are unable to pay your taxes with your assets or potential income before the statute of limitations to collect expires. Note that there are rare exceptions to this rule. Check Your Eligibility for The IRS Fresh Start Program.

Program does not assume any outstanding taxes nor provide legal or tax advice. The IRS Fresh Start Program may help you resolve your federal tax liabilities. The program emphasizes facilitating.

You can pay the IRS a calculated offer amount equal to your reasonable collection potential based on an IRS formula and you can stay in compliance for the next five tax years. Individual results may vary based on ability to save funds and completion of all program terms. So in 2011 yes 8 years ago at the time of this writing the IRS announced the creation of a new initiative known as the FSI.

Concentrate on the Local Market for a Fresh Start Initiative. This is to help willing taxpayers pay off debts without any undue financial hardship. Get help from the most experienced Licensed Enrolled Agents Certified Public Accountants CPAs and.

Speak To Our Tax Relief Experts Now 877 503-3014 Solve Your IRS Tax Problems Before Fresh Start Initiative Expires See If You Qualify. Before the Fresh Start Initiative the IRS issued tax liens for all kinds of liability levels. The program is designed to help individuals and small businesses with overdue tax liabilities and it also has the benefit of helping the IRS by removing taxpayers from its vast collection inventory.

The IRS Fresh Start s a bit of a win-win --- the initiative makes it easier for individual and small. BEFORE FRESH START INITIATIVE EXPIRES. IRS Fresh Start programs under federal law provide real relief but they can be very complexed to navigate.

Fresh Start Wellness Center is a mental health agency that creates and implements mental health programs in the criminal justice and educational system. Taxpayers have lost their jobs and small businesses have seen a dramatic decrease in their revenue due to the forced shutdowns. Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms.

Dont Carry Them Alone. If so the IRS Fresh Start program for individual taxpayers and small businesses can help. Tax Problems Are Heavy.

Under the new rules the IRS does not issue tax liens if the tax owed is less than 10000. While there have been changes to IRS procedures after the Fresh Start Initiative was enacted these have generally only served to expand the benefits of the Fresh Start Initiative. Read and understand all terms prior to enrollment.

Millions of Americans are desperately seeking relief from paralyzing tax debt. A tax lien will be filed with this type of agreement unless the debt is under 10000. IRS Fresh Start Program Simplifies Many Things For Taxpayers.

Economists say that the impact will be felt for many years to come. So without further ado here are 7 ways to transform your business and give it a fresh start this spring in 2022. The payment option may be as long as 72 months or six years.

Expanded Penalty Relief Now expired IRS Fresh Start Tax Lien Changes. Read and understand all. The program puts a premium on providing customers with affordable repayment alternatives rather than imposing fines.

Fighting the IRS is a sure way to risk losing everything you own. This limits the size and severity of your debt. This expansion will enable.

The IRS launched the Fresh Start initiative in 2011 for the purpose of helping more taxpayers to get back in good standing. Many people wonder if the Fresh Start Initiative is still in place today in 2019.

Sue Williams Brawn Acc Pacg Certified Professional Coach Adhd Specialist Fresh Start Coaching Linkedin

Home Electrical Protection Plan Unlimited Repairs Enercare

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

Bankruptcy Fresh Start Program The What And Why Day One Credit

States Are Sitting On Millions Of Surplus Covid 19 Vaccine Doses

Bankruptcy Fresh Start Program The What And Why Day One Credit

What Is The Irs Fresh Start Program 72 Month Installment Agreement

Community Fridges Pop Up In Toronto Neighbourhoods During Covid 19 Pandemic

Sue Williams Brawn Acc Pacg Certified Professional Coach Adhd Specialist Fresh Start Coaching Linkedin

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Bankruptcy Fresh Start Program The What And Why Day One Credit

The Irs Tax Debt Forgiveness Program Explained

Canada S Top Secured Card For Credit Building Refresh Financial

How To Find Csed Irs Wilson Rogers Company

Bankruptcy Fresh Start Program The What And Why Day One Credit

Irs Fresh Start Program Guide With 2021 Updates Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program

Irs Fresh Start Initiative A Guide To The Fresh Start Tax Program